🚨 Bristol-Myers Squibb and Pfizer plan to sell the widely used blood thinner Eliquis directly to patients at a discounted cash price”Joint venture launching direct-to-consumer service of Eliquis after discussions with Trump administration”https://www.wsj.com/health/pharma/bristol-myers-pfizer-eliquis-discount-3c0513ef

“Too Late:” Great numbers just out. LOWER THE RATE!!! DJT

“Too Late:” Great numbers just out. LOWER THE RATE!!! DJT

Who Are The Ultra-Orthodox Jews, Why Are They Abandoning Netanyahu Amid Gaza War? PM Loses Majority?

Can India & China Come Together As NATO Threatens Over Trade With Russia? Watch #shorts

Israel Planning Al-Sharaa Kill Plot? ‘Eliminate Snake’s Head’ Call As IDF Enters Druze War In Syria

US NEWS LIVE | FBI Director Explodes After Trump Insult Sparks Outrage in U.S. Senate | TRUMP NEWS

Reporter in Damascus reacts as Israeli strikes hit Syrian Defense Ministry behind her

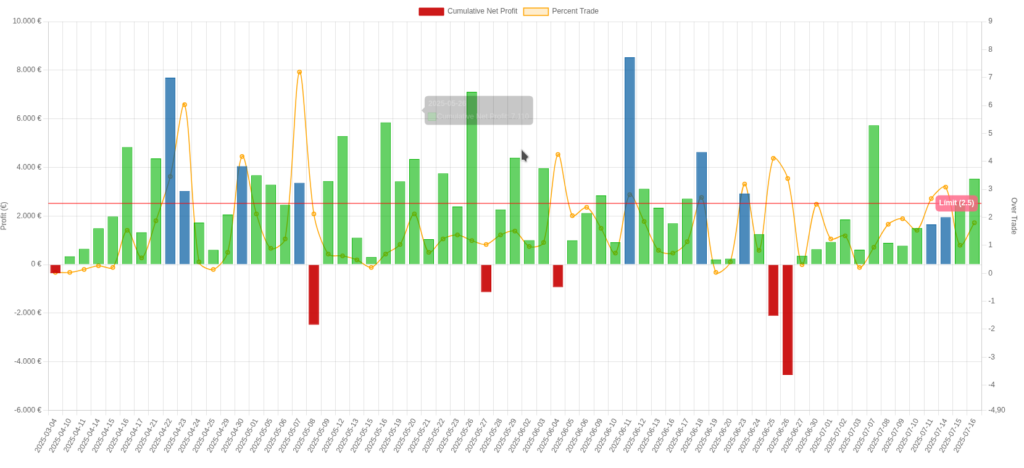

🧠 Trading Beyond Numbers: Understanding the 2.5 Line

In my ongoing development as a trader, I’ve started building a new custom prompt for ChatGPT — not just to analyze my stats, but to understand the emotional consequences behind the numbers. This isn’t about motivation. It’s about data-driven introspection and becoming emotionally efficient.

Let’s talk about what I’ve discovered with a simple line: the 2.5 limit.

✅ The 2.5 Line Is Not Arbitrary

It’s not a random number on a chart.

It’s a threshold I’ve defined based on my trading style and emotional history.

When my “Percent Trade” exceeds 2.5, even on winning days, I cross into psychological danger territory.

“Yes, I can make $9,000… but then I crash mentally.”

That’s not weakness — it’s a signal.

It’s emotional efficiency. Long-term survival over short-term dopamine.

✅ Blue Days Are Elegant Red Flags

Blue bars in my charts may look impressive, but they come at a hidden cost:

- They drain me mentally.

- They raise my self-imposed expectations, making the next day feel heavier.

- And they disconnect me from my core trading process, because I win by intensity, not by precision.

What feels like victory today, can be the seed of inconsistency tomorrow.

✅ The Real Limit Is Habit, Not Skill

Now that I’ve identified 2.5 as a stress threshold, the real goal is not avoiding it once —

but making daily discipline the standard.

It’s not about being less ambitious.

It’s about sustainable intensity — high performance with low emotional drawdown.

🔄 What Comes Next?

I’m training a system (and myself) to recognize when performance is deceivingly good.

Because great trades don’t just show in the profit column —

they show in how you feel the next day.

This is part of a larger evolution.

Less glory, more mastery.

If you’ve ever looked at a $9,000 day and felt empty the next morning —

you’re not broken.

You’re just starting to see the real rules of the game.